Everything You Need to Know About Tawuniya’s Vehicle Insurance Pricing, Discounts & Comparisons

🧭 Introduction

Car insurance is not just a legal requirement in Saudi Arabia — it’s also an essential part of responsible vehicle ownership. Among the many insurers in the Kingdom, Tawuniya (The Company for Cooperative Insurance) stands out as one of the most trusted and established names in the industry.

But one question is on the mind of every driver:

“What is the Tawuniya car insurance price in Saudi Arabia?”

This guide provides a detailed breakdown of Tawuniya’s car insurance offerings, how pricing works, and how to save money — whether you’re buying your first policy, switching providers, or renewing.

We’ll walk you through:

- Types of car insurance offered by Tawuniya

- Average price ranges in 2025

- Cost factors (car model, age, location, etc.)

- How to get quotes online

- Discounts, offers, and comparisons with other providers

By the end of this guide, you’ll be equipped to make an informed decision and get the best possible deal.

🏢 Who is Tawuniya?

Founded in 1986 and headquartered in Riyadh, Tawuniya (The Company for Cooperative Insurance) is one of Saudi Arabia’s leading insurance providers. It operates under the supervision of the Saudi Central Bank (SAMA) and is publicly listed on the Tadawul stock exchange.

With a vast customer base and decades of experience, Tawuniya offers a range of insurance products, including:

- Car insurance

- Health insurance

- Travel insurance

- Property and liability coverage

Tawuniya is often chosen for its:

- ✅ Strong financial standing

- ✅ Nationwide presence

- ✅ High trust level among individuals and businesses

- ✅ Digital services and claim support

Now let’s focus on what you came here for — Tawuniya car insurance prices.

🚘 Types of Tawuniya Car Insurance Coverage

Tawuniya offers two main types of vehicle insurance. Each has different benefits, levels of protection, and pricing:

🔹 1. Third-Party Liability (TPL) Insurance

This is the minimum legal requirement for driving in Saudi Arabia. It covers:

- Damages caused to another person’s vehicle

- Injury to third parties

- Legal liabilities

However, it does not cover:

- Your own vehicle damage

- Theft or fire

- Personal injuries (unless optional add-ons are selected)

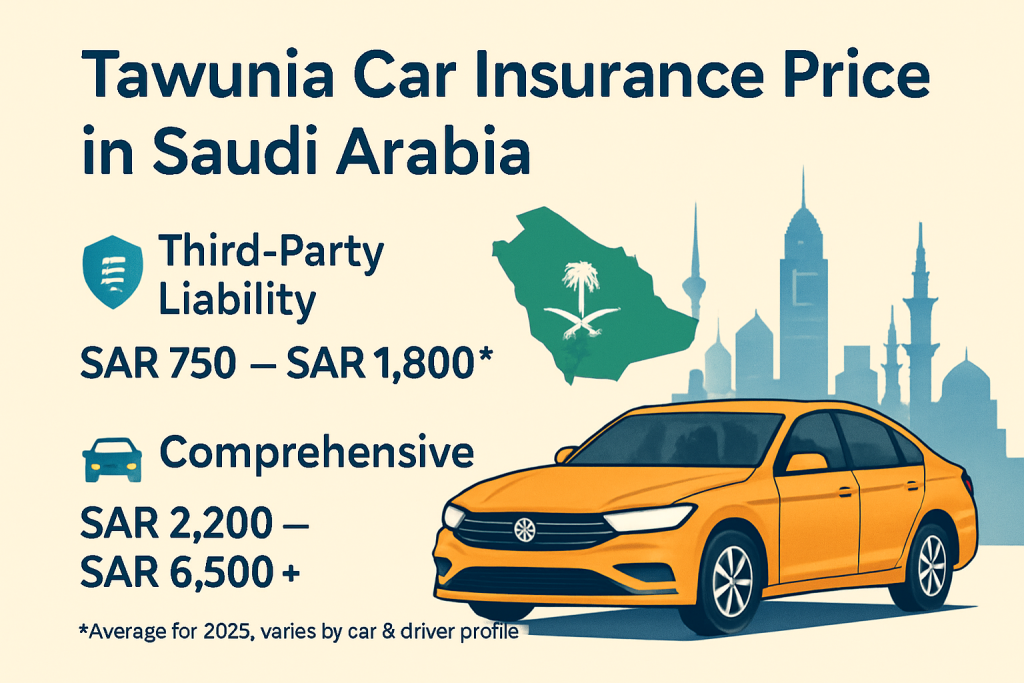

📉 Tawuniya TPL Price Estimate (2025):

- Starting from SAR 750 – SAR 1,800 depending on driver and vehicle profile

🔹 2. Comprehensive Car Insurance

This offers full protection, covering:

- Third-party damages

- Damage to your own vehicle (collision, theft, fire, vandalism)

- Natural disasters (flood, hail, sandstorms — depending on terms)

- Roadside assistance (optional)

- Replacement vehicle (optional)

📉 Tawuniya Comprehensive Price Estimate (2025):

- Starting from SAR 2,200 – SAR 6,500+

Prices depend heavily on:

- Type of car (sedan, SUV, luxury, etc.)

- Value and age of the vehicle

- Claims history

- Driver age and experience

📝 Note: Optional add-ons can affect pricing significantly. Examples include windshield cover, GCC coverage, and off-road protection.

💰 What Affects Tawuniya Car Insurance Price?

Now let’s dive into the key factors that influence pricing. Whether you’re buying third-party or comprehensive coverage, your quote will be based on several variables.

1. 🚗 Vehicle Type & Value

- New, expensive, or luxury cars (like BMW, Lexus, or Range Rover) will cost more to insure.

- Economy cars (like Toyota Yaris, Hyundai Accent, or Nissan Sunny) generally get lower premiums.

- SUVs or commercial-use vehicles may attract higher rates due to size and risk factors.

2. 👤 Driver Profile

- Age: Young drivers (under 25) are considered high-risk.

- Gender: In some cases, males pay more due to higher accident stats.

- Driving Experience: New drivers are usually charged more.

- Nationality: While all nationalities are eligible, certain platforms may factor this into pricing.

3. 📍 Location

- Residents in Riyadh, Jeddah, or Dammam may pay more due to high traffic density.

- Smaller cities may offer cheaper pricing due to reduced accident risk.

4. 📅 Driving Record & Claims History

- Clean driving history? You’re more likely to get a lower premium.

- Drivers with accident claims or violations may see higher prices.

5. 🛡️ Coverage Type

- Naturally, comprehensive insurance is more expensive than third-party.

- However, it offers far more protection and peace of mind — especially for newer cars.

6. 🚦 Annual Mileage & Usage

- Cars used daily for long commutes may be priced higher.

- Occasional drivers or those with low mileage may get discounted rates.

7. 📉 Optional Add-Ons

Add-ons are valuable, but they raise your price:

- Roadside assistance

- Replacement car during repair

- GCC coverage (driving in UAE, Bahrain, etc.)

- Off-road driving cover (useful for desert trips)

8. 🔄 Renewal History

- If you’re renewing with Tawuniya and have no claims, you may get a loyalty discount.

- Delaying renewal or switching frequently may affect offers.

9. 📑 Documents & Accuracy

Incorrect or incomplete information can result in a higher quote or rejection. Always provide:

- National ID or Iqama

- Vehicle registration (Istimara)

- Driving license

- Valid mobile number and email